A flexible spending account (FSA) is a tax-exempt financial account that can be set up through your employer to help cover the cost of medical co-lays, prescriptions and medical procedures. If your employer offers a flexible spending plan, you can set aside up to $2,500 of pretax income to use toward medical, dental and vision expenses.

A flexible spending account (FSA) is a tax-exempt financial account that can be set up through your employer to help cover the cost of medical co-lays, prescriptions and medical procedures. If your employer offers a flexible spending plan, you can set aside up to $2,500 of pretax income to use toward medical, dental and vision expenses.

Does FSA cover weight loss surgery?

Your health FSA will cover a wide variety of eligible expenses, depending on the exact nature of your plan. Under the standard health FSA, bariatric surgery such as Lap-Band and gastric bypass are covered, assuming you have appropriate documentation by a physician recommending the surgery as treatment for a medical condition.

Changes coming to FSA in 2014

Over the years, FSA rules and guidelines have changed, and 2014 is no exception. The most significant change to the FSA guidelines effective in 2014 is clarification to the “use-it-or-lose-it” rule.

Under previous guidelines, any remaining funds in your FSA account could not be rolled over to the next year — so what wasn’t used during the coverage year was lost. In 2008, a modification was made to this rule allowing employers to offer a “grace” period that runs through March 15 of the following year.

Under the new rule, if your employer does not currently offer a grace period, you can carry up to $500 of unused funds with you into the next year. If your employer has filed necessary paperwork and amendments, you may apply up to $500 remaining funds from 2013 to the 2014 coverage year. That carryover amount does not count against your $2,500 limit for 2014. Essentially, you have an extra $500 to use in 2014.

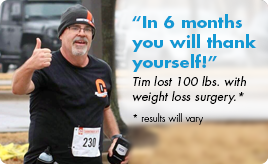

Covering the cost of weight loss surgery

The Nicholson Clinic accepts all major insurance plans. Bariatric procedures are typically covered by insurance companies, providing the patient meets insurance requirements. These requirements are often a body mass index (BMI) of 35 with underlying health conditions, or a BMI of 40+ with no underlying health conditions. If your insurance covers the cost of your weight loss surgery, you will be responsible for deductibles and co-pays.

Providing your surgery is considered medically necessary, you may apply health FSA funds to your out-of-pocket costs, making bariatric surgery even more affordable.

We are committed to helping every patient get the weight loss surgery they need — no exceptions. We offer flexible payment plans with monthly payments as low as $236.

If you are considering bariatric surgery, but are concerned about the cost, we have patient care advocates on staff to help you manage the process, whether you use insurance or choose to pay for the surgery yourself.

The statements above are general rules regarding flexible spending accounts. Talk to your employer to determine whether or not bariatric surgery is considered an eligible expense under your flexible spending plan.